Get the free vanguard transfer on death form

Fill out, sign, and share forms from a single PDF platform

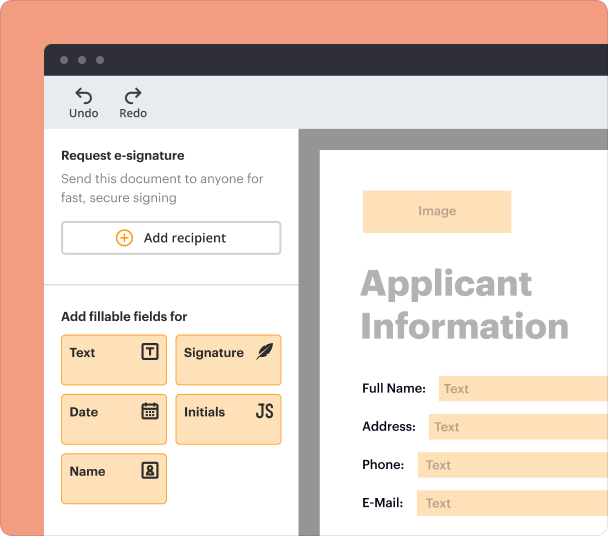

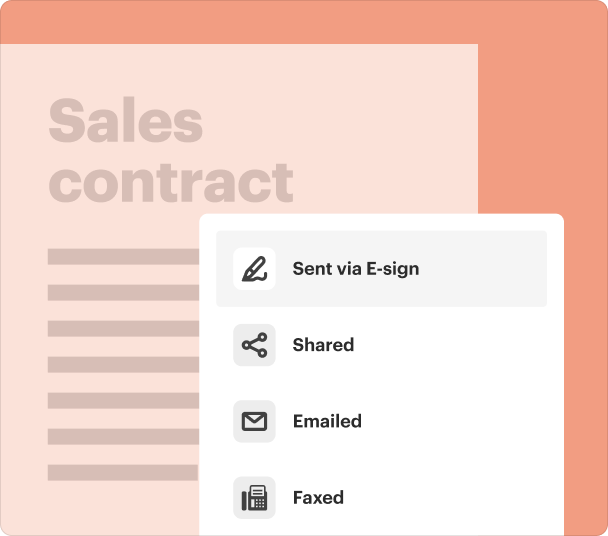

Edit and sign in one place

Create professional forms

Simplify data collection

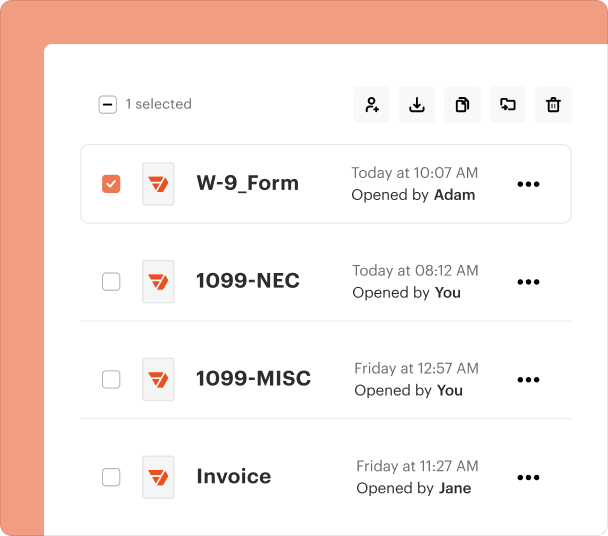

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

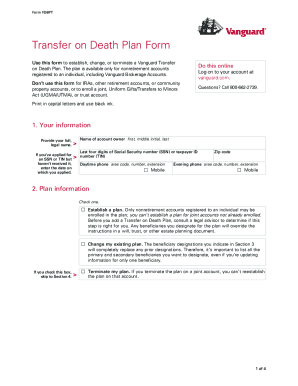

Comprehensive Guide to the Transfer on Death Plan Form

What is a transfer on death plan?

A transfer on death plan (TOD) is a legal document that allows an individual to designate beneficiaries for their assets, enabling a smooth transfer upon their passing. This kind of estate planning tool specifically covers various forms of property such as bank accounts, vehicles, and real estate, safeguarding them from probate delays and costs.

-

The main purpose of a TOD plan is to simplify the asset transfer process after death, avoiding probate, which can be a lengthy and costly procedure.

-

Assets typically included under a TOD plan can range from vehicles to real estate, allowing for a wide array of ownership types.

-

Utilizing a TOD plan facilitates better estate management, providing peace of mind by ensuring that beneficiaries receive assets promptly and efficiently.

Is the transfer on death plan right for you?

Deciding whether a transfer on death plan suits your needs involves evaluating your financial circumstances and existing estate arrangements. By carefully assessing your situation, you can identify key factors that will assist you in making an informed choice regarding enrollment.

-

Evaluate your current assets and liabilities; understanding your financial health is crucial for devising a fitting estate plan.

-

Before enrolling, consider factors like your family dynamics, potential beneficiaries, and whether you plan to update your beneficiaries regularly.

-

A legal advisor can provide personalized guidance, ensuring that you align your transfer on death plan with your overall estate strategy.

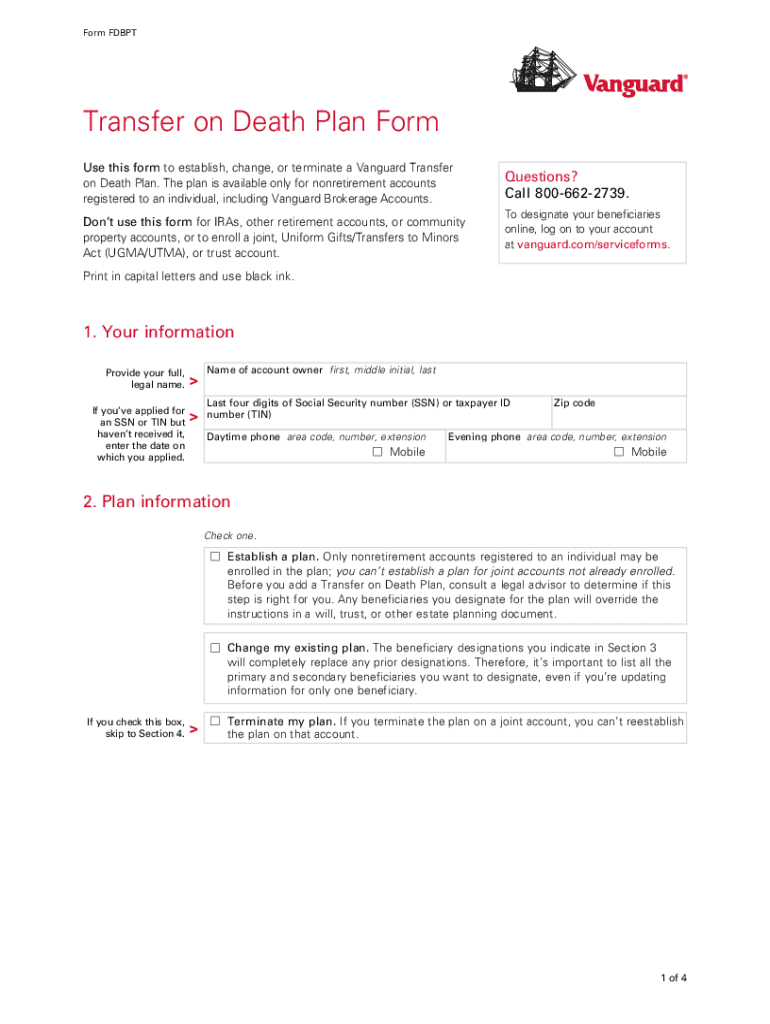

How to complete the transfer on death plan form?

Completing the transfer on death plan form requires organized preparation and attention to detail. The following checklist provides a comprehensive overview of the required information, ensuring that you fill out the form accurately.

-

Gather important details such as asset descriptions, beneficiary names, and their relationship to you to enhance clarity and accuracy.

-

The form typically includes sections for your personal information, a detailed list of assets, and instructions for designating beneficiaries.

-

Ensure you double-check your entries to avoid common errors such as misspellings or lacking required signatures.

What is the enrollment process?

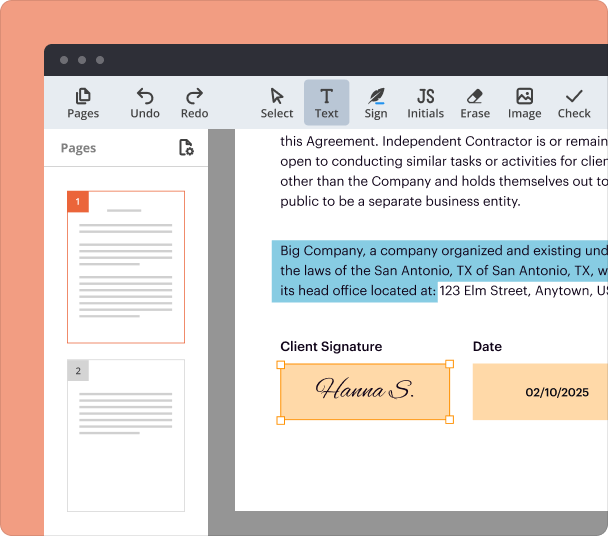

Submitting your transfer on death plan form can be a straightforward process when utilizing platforms like pdfFiller. Following a clear procedure will help you navigate potential complexities with ease.

-

pdfFiller offers a user-friendly platform for submitting your TOD plan form, allowing for easy digital editing and eSigning.

-

Once submitted, you should receive a confirmation of your application alongside updates regarding your beneficiary designations.

-

Be prepared for potential issues; understanding common hurdles facilitates quicker troubleshooting and resolution.

How do you manage your transfer on death plan post-enrollment?

Post-enrollment, managing your transfer on death plan is crucial to ensure that your estate reflects your current wishes. This process involves maintaining accurate beneficiary designations and reviewing your plan regularly.

-

Life changes may necessitate updates to your designations; ensure you revisit and amend your plan in line with your current situation.

-

Keep your beneficiaries informed about your TOD plan, preparing them for what to expect after your passing.

-

Annual reviews of both your beneficiaries and overall estate plan are essential, helping to ensure that your assets are allocated according to your wishes.

What are the legal and tax implications?

Understanding the legal and tax implications of a transfer on death plan is vital for effective estate planning. This ensures that your assets are managed in compliance with relevant laws while minimizing tax liabilities.

-

The TOD plan needs to align with your overall estate strategy, as improperly structured plans can lead to legal disputes.

-

Beneficiaries should be aware of potential tax liabilities, as assets may be subject to capital gains tax based on current market value.

-

Be alert to common pitfalls such as not fully understanding the tax implications of your designated beneficiaries, which can lead to unintended consequences.

How can you use pdfFiller resources?

pdfFiller provides a suite of interactive tools and resources designed to streamline the document management process. Utilizing these tools can enhance the efficiency of your TOD plan management.

-

pdfFiller's platform enables users to easily edit their documents and securely eSign, making the management of your TOD plan straightforward.

-

Working with teams can optimize document handling, allowing for collaborative efforts when coordinating estate management.

-

pdfFiller's support services provide valuable guidance, ensuring users have assistance throughout their document management journey.

Frequently Asked Questions about vanguard tod form

What is a transfer on death plan?

A transfer on death plan enables you to designate beneficiaries for your assets, allowing for their transfer without going through probate. It simplifies estate management.

How do I enroll in a transfer on death plan?

To enroll, fill out the transfer on death plan form accurately and submit it through platforms like pdfFiller, ensuring all required information is included.

Can I change my beneficiaries after enrolling?

Yes, you can modify your beneficiary designations at any time after enrollment. Regular reviews of your estate plan can help ensure it reflects your current wishes.

What are the tax implications for beneficiaries?

Beneficiaries should understand potential tax liabilities associated with inherited assets, such as capital gains taxes, depending on the asset types and market values.

How does pdfFiller facilitate document management?

pdfFiller offers intuitive editing, eSigning, and collaboration tools, making it easier to manage your documents, including forms like the transfer on death plan.

pdfFiller scores top ratings on review platforms