Get the free vanguard transfer on death form

Show details

1 In General. You may establish a Vanguard completed and signed Vanguard Transfer on Death Plan Form the Application Form to Vanguard subject to Vanguard s acceptance. O. Box 1110 Valley Forge PA 19482-1110 455 Devon Park Drive Wayne PA 19087-1815 Print Entire Kit Print Form Only The Vanguard Group Inc. All rights reserved. 4 of 4 Vanguard Transfer on Death Plan Agreement Article I Introduction 1. What s inside Is the plan right for you Transfer...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vanguard tod form

Edit your vanguard transfer on death form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vanguard death notification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vanguard transfer on death form pdf online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit vanguard tod form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

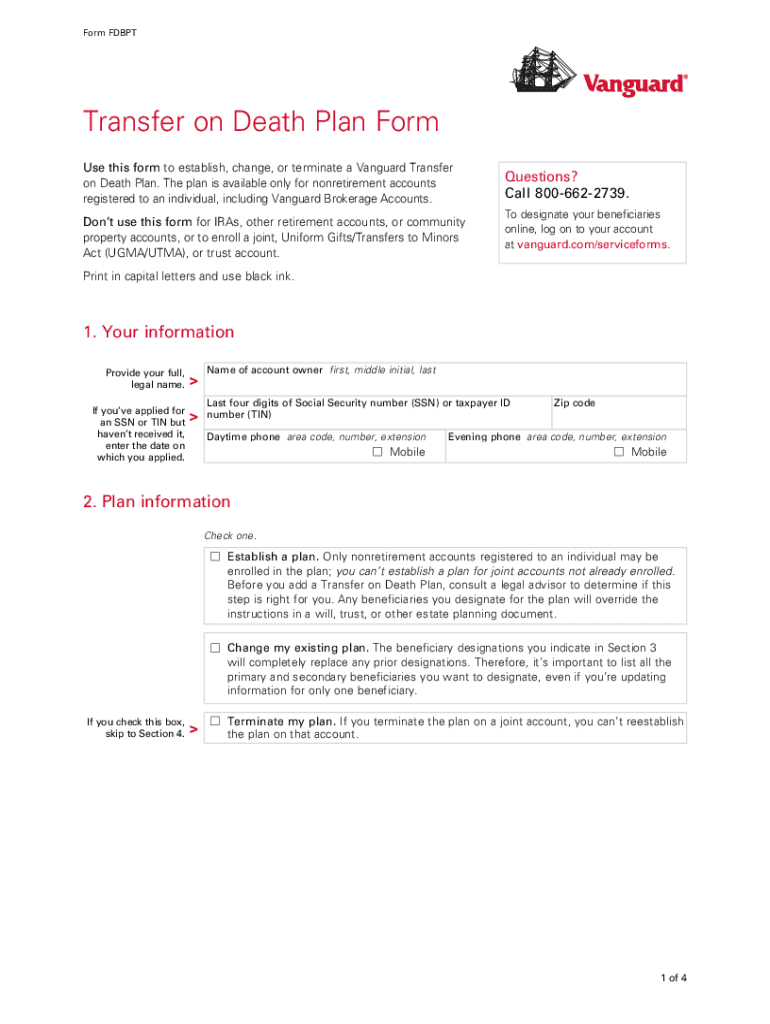

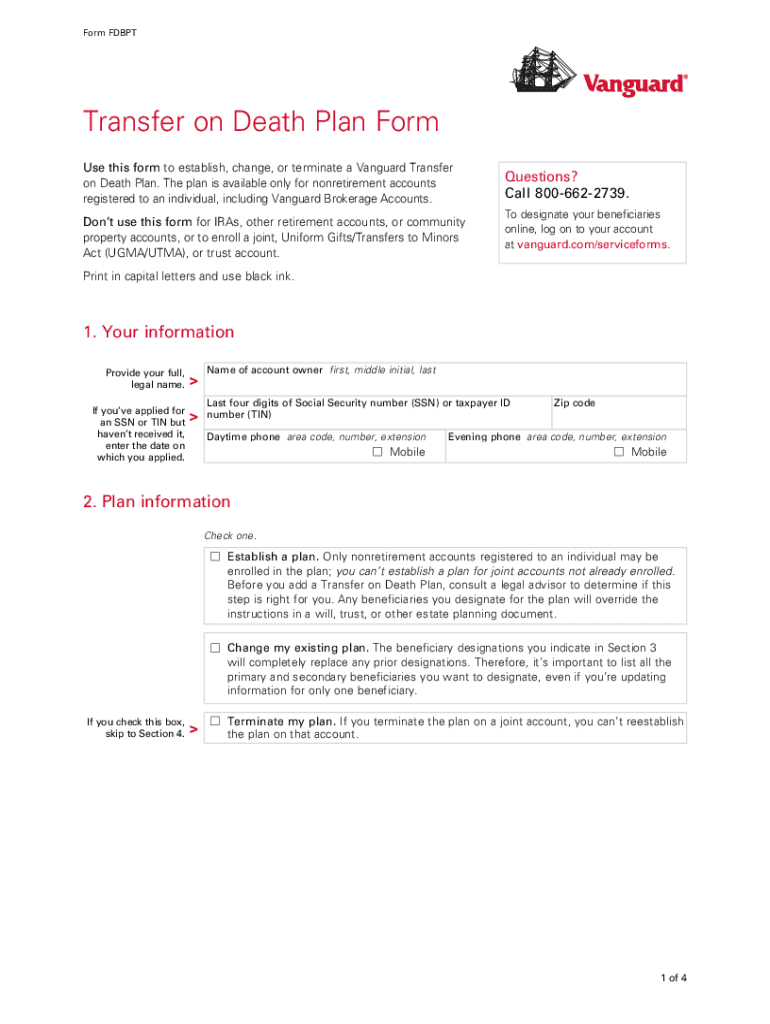

How to fill out vanguard transfer on death plan form

How to fill out vanguard transfer on death:

01

Gather all necessary information: You will need the name, address, and social security number of both the transferor (the current account owner) and the transferee (the individual or organization that will receive the account upon the transferor's death). Make sure to have this information readily available before starting the process.

02

Log in to your Vanguard account: Visit the Vanguard website and log in using your username and password. If you don't have an online account, you will need to create one before proceeding.

03

Locate the transfer on death form: Once logged in, navigate to the appropriate section of your account where the transfer on death options are located. This may vary depending on the specific Vanguard account you have, so refer to the Vanguard website or contact Vanguard customer service for assistance if needed.

04

Read the instructions carefully: Before filling out the form, take the time to carefully read the instructions provided. Understand the requirements, limitations, and any additional documentation that may be required to complete the transfer on death.

05

Provide the necessary information: Fill out the form with accurate and complete information. This includes the transferor's and transferee's personal details, as well as any specific instructions or designations related to the transfer on death.

06

Review and submit the form: Carefully review the information provided on the form to ensure accuracy. Double-check all names, addresses, and other details. Once you are satisfied with the accuracy of the information, submit the form as per the instructions provided.

Who needs vanguard transfer on death?

01

Individuals who wish to specify a designated beneficiary for their Vanguard account upon their death may opt for a Vanguard transfer on death.

02

This facility is particularly useful for individuals who want to ensure a smooth and efficient transfer of their Vanguard assets directly to their chosen beneficiary, bypassing probate.

03

Anyone who wants to maintain control over the distribution of their Vanguard investments after their passing may find it beneficial to utilize the transfer on death feature.

Fill

vanguard change of ownership due to death

: Try Risk Free

People Also Ask about vanguard phone number

How do I report the death of account holder to Vanguard?

Log in (if you're a Vanguard client already) or register for online access (if you're not a Vanguard client already) by creating a username and password. Provide information about the person who passed away. Vanguard will then attempt to verify that the person has passed away using our systems.

How do I designate a beneficiary on my Vanguard account?

How do I add a beneficiary? Select Profile & Account Settings from the main navigation. On the Beneficiaries page, choose the account (for non-retirement) or account grouping (for retirement) you'd like to designate beneficiaries for. Choose your desired Allocation, then select Continue.

Does Vanguard have transfer on death accounts?

The Transfer on Death Plan offers a convenient way to pass certain types of Vanguard nonretirement assets to your heirs outside of probate. You retain full control of the assets during your lifetime; the named beneficiaries receive them only after your death.

Does Vanguard offer inherited IRA accounts?

The short answer: Anyone can be a beneficiary on your IRA, including minor children. And your beneficiaries don't need to be family members. It's important that the beneficiaries listed on your Vanguard accounts match your beneficiaries' legal names when they inherit the accounts, so don't use nicknames.

How do I send a death certificate to Vanguard?

How do I notify Vanguard of death? Call us at 800-662-2739. The Transfer on Death Plan is a straightforward way to designate beneficiaries for certain Vanguard nonretirement mutual fund and/or brokerage accounts.

What to do when an account holder dies Vanguard?

Log in (if you're a Vanguard client already) or register for online access (if you're not a Vanguard client already) by creating a username and password. Provide information about the person who passed away. Vanguard will then attempt to verify that the person has passed away using our systems.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my vanguard report a death in Gmail?

Create your eSignature using pdfFiller and then eSign your frequently asked questions about vanguard it reflects your current wishes immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out log in if you're need to be family members using my mobile device?

Use the pdfFiller mobile app to fill out and sign people also ask about vanguard need to be family members. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How can I fill out what is vanguard transfer on upon their death avoiding probate on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your vanguard payable on death. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is vanguard transfer on death?

Vanguard transfer on death (TOD) is a financial arrangement that allows account holders to designate beneficiaries who will inherit their investment assets automatically upon their death, avoiding probate.

Who is required to file vanguard transfer on death?

No one is required to file Vanguard transfer on death, but account holders wishing to establish a TOD designation must complete the necessary forms and ensure they are on file with Vanguard.

How to fill out vanguard transfer on death?

To fill out the Vanguard transfer on death form, account holders must provide their personal information, specify beneficiaries (including their names and relationships), and sign the form to confirm the designation.

What is the purpose of vanguard transfer on death?

The purpose of Vanguard transfer on death is to facilitate the seamless transfer of assets to designated beneficiaries without going through the probate process, helping to ensure that assets are distributed quickly and according to the account holder's wishes.

What information must be reported on vanguard transfer on death?

The information that must be reported on the Vanguard transfer on death includes the account holder's details, the names and contact information of the beneficiaries, the percentage of assets each beneficiary should receive, and any other relevant personal identification information.

Fill out your vanguard transfer on death online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is Vanguard Transfer On Death Vanguard Allows Account Holders To Designate Beneficiaries Who is not the form you're looking for?Search for another form here.

Keywords relevant to how to fill out vanguard transfer on death form to confirm the designation

Related to select profile account settings from an account holder dies vanguard

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.